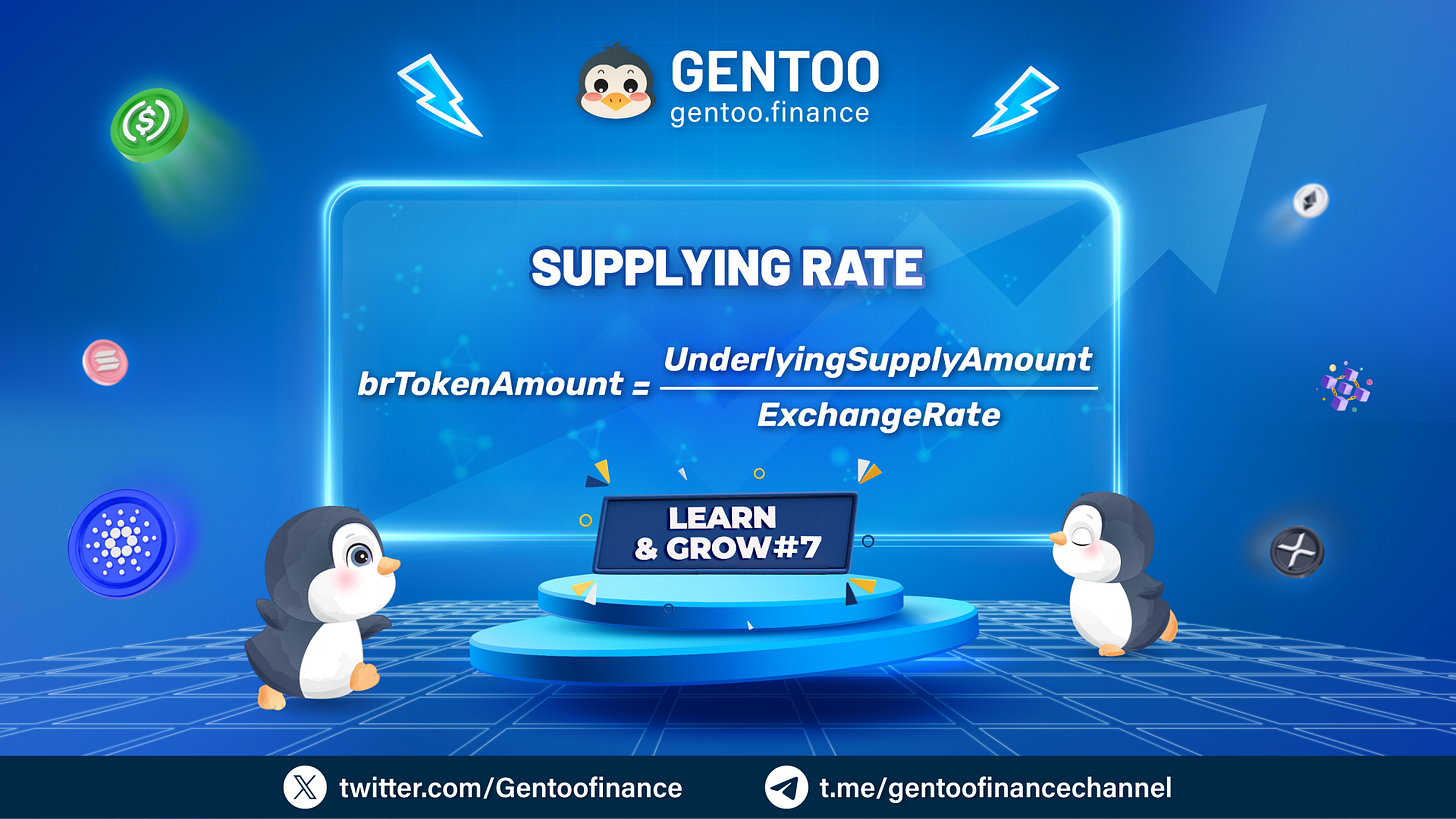

📚 Learn & Grow with Gentoo #7: Unveiling the Supplying Rate Formula 📐

Welcome back Gentoo Community,

Today let's talk about another illuminating episode of our "Learn & Grow with Gentoo" series! In this session, we'll delve into a fundamental formula related to Bearing Tokens - the Supplying Rate 💹

💡 What is the Supplying Rate?

The Supplying Rate is a vital formula within the context of Passive Pools. It determines the amount of brTokens you'll receive when you supply an asset into the passive pool.

📈 Formula for Supplying Rate

brToken Amount = Underlying Supply Amount / Exchange Rate

🔑 Importance of the Supplying Rate

Understanding the Supplying Rate is essential for participants in passive pools. It allows you to calculate how many brTokens you'll receive for supplying your assets, helping you make informed decisions about your participation. A deeper comprehension of this rate empowers you to maximize your returns within Gentoo's DeFi ecosystem.

The next ep we will reveal the last formula related to Bearing Token. Stay tuned for more knowledge-packed episodes 🔥🔥

In case you missed the previous eps, roll down and read it!

➡️️️️ Ep 1 ➡️️️️ Ep 2 ➡️️️️ Ep 3

🐧About Gentoo Finance

Gentoo Finance is a composable leverage protocol. It has two sides to it: passive lenders who earn low-risk APY by lending single assets; and active farmers, firms, or even other protocols who borrow those assets to farm with even x10 leverage.

Gentoo Finance allows anyone to take DeFi-native leverage and then use it across various (DeFi & more) protocols. This enables you to increase your earning capital. You take leverage with Gentoo and then use it on other protocols on the BNB Chain ecosystem: Pancakeswap, Ankr, Wombat, Magpie, etc. For example, you can leverage liquidity on Wombat Exchange, leverage farming capital on Magpie Protocol, and more...

Website |Twitter |Telegram |Discussion |Discord |Substack |Whitepaper